What is the cost of closing?

Closing costs are additional fees that you pay at the end of the home buying process. Taxes and fees that are related to real estate transactions are included. These fees are split between the buyer and seller depending on the responsibility of each party.

These costs can be a combination between one-time charges and initial monthly installments for recurring expenses. These recurring fees can include homeowners insurance or property tax payments. They vary depending on the lender.

Some of the one-time charges are fixed fees, while others depend on the amount borrowed. There will be an application fee as well as attorney and courier fees.

Costs of closing for a buyer

The average buyer will have to pay about six percent of the purchase price in closing costs, which fluctuate by state and local property tax rates. These fees can include the title company fee, escrow charge, appraisal fee and record filing.

What is the average amount of closing costs on a refinance?

Closing costs for a refinance are typically lower than those for a purchase. But they still must be taken into account. A Loan Estimate is usually sent by lenders to the buyer within three days after they apply for a mortgage. It includes estimated closing costs as well as other details.

This estimate should not just be accurate, it should also make sense. Ask questions when you're not sure about something.

What are closing costs when selling a home?

Most home sellers are required to pay for a number of closing expenses, such as broker's commissions or property transfer tax. They often also have to pay for prepaid interest on the mortgage, as well as home inspection and pest inspection fees.

The service provider can lower the fees if you can negotiate with them. The seller can offer a credit to the buyer, which covers a part of their closing costs.

How can you avoid closing costs?

Shopping around for the right mortgage is the best way to avoid these costs. It's important to consider your credit score, debt-to-income ratio, and down payment amount before you apply for a mortgage.

You can then research prices for your desired city and neighborhood. Compare different lenders, their fees, and other factors before you make a final decision.

Sellers are also required to pay a seller’s mortgage recording fee as well as title transfer fees, which usually amounts to about 1.825%. The fees are often forgotten by buyers. However, they can add as much 2% to a resale house's price.

FAQ

What are the key factors to consider when you invest in real estate?

First, ensure that you have enough cash to invest in real property. If you don’t save enough money, you will have to borrow money at a bank. Also, you need to make sure you don't get into debt. If you default on the loan, you won't be able to repay it.

Also, you need to be aware of how much you can invest in an investment property each month. This amount must include all expenses associated with owning the property such as mortgage payments, insurance, maintenance, and taxes.

It is important to ensure safety in the area you are looking at purchasing an investment property. It is best to live elsewhere while you look at properties.

How can I calculate my interest rate

Market conditions affect the rate of interest. The average interest rates for the last week were 4.39%. Add the number of years that you plan to finance to get your interest rates. If you finance $200,000 for 20 years at 5% annually, your interest rate would be 0.05 x 20 1.1%. This equals ten basis point.

Should I rent or purchase a condo?

Renting is a great option if you are only planning to live in your condo for a short time. Renting will allow you to avoid the monthly maintenance fees and other charges. On the other hand, buying a condo gives you ownership rights to the unit. You are free to make use of the space as you wish.

Statistics

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

External Links

How To

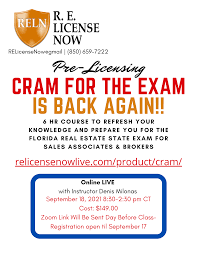

How to be a real-estate broker

To become a real estate agent, the first step is to take an introductory class. Here you will learn everything about the industry.

Next, you will need to pass a qualifying exam which tests your knowledge about the subject. This requires that you study for at most 2 hours per days over 3 months.

Once you have passed the initial exam, you will be ready for the final. In order to become a real estate agent, your score must be at least 80%.

These exams are passed and you can now work as an agent in real estate.