A veteran who served in the military can apply for a real estate license using their GI Bill. Your GI Bill may also pay for certification tests. You can find more information at the Department of Veterans Affairs. You may be able to apply for reimbursement by contacting the Department of Veterans Affairs.

For a military veteran who is not currently serving, there are a few other ways to obtain a license. First, scholarships can be available to cover some of the costs. Depending on the program, you can receive a scholarship of up to $1,000. These scholarships are available only for classroom-based courses.

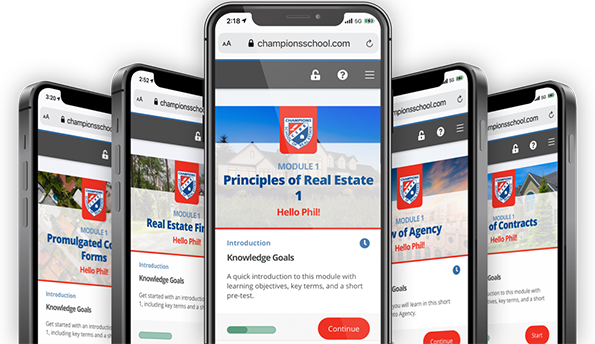

An online pre-license class is another option. AceableAgent offers a variety of courses for people interested in obtaining a real estate license. These courses are relatively inexpensive and include all the training you will need. Other costs involved in obtaining your real estate license will be added to your bill.

Several national brokerages have also begun to offer programs to recruit veterans. One example is the Northern Virginia Association of Realtors, which offers a program for transitioning military personnel to get started in the real estate industry. Interested veterans should submit a certificate of eligibility and a DD214.

Florida Real Estate University has a prelicense course that you can take if you don't have a license as a real estate agent. The university offers a 63 hour pre-licensing sales associate class. Although there are fees, the VA will pay them. This will make it possible to get your real estate license in just a few weeks.

Operation RE/MAX can also help. This program matches veterans and their spouses to mentors who will help them navigate the path of becoming licensed real-estate professionals. They will then be required for a 24-month commitment to BHGRE's Xcelerater Program. They will be able to start work once they have passed the real estate exam.

A waiver can be requested by active-duty personnel for the initial licensing cost. This can be done online and by mailing an application to assessor. It is important to note that a waiver does not apply to the renewal of your license, or any criminal background checks.

Members of the military can take advantage of many benefits offered by Texas Real Estate Commission. This includes an expedited registration process. This program is available to military personnel who have a valid license in another state.

Veterans to REP is open to both active military personnel and reserve soldiers. Additionally, military spouses enjoy additional benefits. Both programs provide post-licensing support and training.

Another option is to contact the Department of Veterans Affairs to determine if your certification and license costs can be reimbursed. The VA website lists approved programs for reimbursement of real-estate licenses.

FAQ

How can I get rid of termites & other pests?

Your home will eventually be destroyed by termites or other pests. They can cause damage to wooden structures such as furniture and decks. It is important to have your home inspected by a professional pest control firm to prevent this.

What are the cons of a fixed-rate mortgage

Fixed-rate loans are more expensive than adjustable-rate mortgages because they have higher initial costs. You may also lose a lot if your house is sold before the term ends.

What should I look for in a mortgage broker?

A mortgage broker helps people who don't qualify for traditional mortgages. They compare deals from different lenders in order to find the best deal for their clients. Some brokers charge a fee for this service. Others provide free services.

What are the pros and cons of a fixed-rate loan?

A fixed-rate mortgage locks in your interest rate for the term of the loan. This ensures that you don't have to worry if interest rates rise. Fixed-rate loans offer lower payments due to the fact that they're locked for a fixed term.

Statistics

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

External Links

How To

How to become real estate broker

The first step in becoming a real estate agent is to attend an introductory course where you learn everything there is to know about the industry.

Next, you will need to pass a qualifying exam which tests your knowledge about the subject. This means that you will need to study at least 2 hours per week for 3 months.

Once you have passed the initial exam, you will be ready for the final. For you to be eligible as a real-estate agent, you need to score at least 80 percent.

You are now eligible to work as a real-estate agent if you have passed all of these exams!