Multi-family mortgage loans are available. There are many things you need to take into consideration. These factors include your down payment, the interest rate, and other financing options. This article will detail the rates and down payments required for these types. Once you have these details figured out, you'll be able to choose the best mortgage loan for your situation.

Multifamily mortgage loan rates

Multi-family mortgage loans have a variety of factors that can influence their interest rates. These loans have higher reserve requirements than conventional loans. Because multifamily loans have a higher level risk, they are generally more expensive. Buyers should search for lenders that specialize in multifamily loans.

The traditional FHA loan program allows multifamily property owners to purchase up to four units. You will enjoy a lower down payment and a lower interest rate, among other benefits. There are also lower requirements and a lower DTI.

Down payment requirements

The down payment requirements for multi family mortgage loans vary depending on the type of property. For example, a three-unit multifamily property may require a 20% down payment, while a two-unit multifamily property might only require a 5% down payment. Different banks have different guidelines about how much down payment is required for multifamily properties.

While the down payment required for multi-family properties is significantly higher than that of single-family homes, you can still get approved with a low down payment. Some programs may require as low as five percent down; some lenders may even allow zero down. There are programs that let you borrow the down payment from a parent, relative, or friend to help finance a portion.

Interest rate requirements

You will need to satisfy several requirements in order to be eligible for a multifamily mortgage loan. Pre-qualification is the first step. This involves an assessment of your credit, income, assets, and other information. Most lenders require a score of at least 620 to process a loan.

Other financing options

Alternative financing presents some challenges. There are a few challenges associated with alternative financing. These include limited documentation and a lack of data about the effectiveness of alternative funding. Also, there are wide variations between states regarding the types of alternative finance available. The lack of research can hinder policymakers from assessing the harms and benefits of alternative financing.

Private equity, online marketplaces, and debt funds are some of the alternatives to multifamily mortgage loan financing. Private equity funds are frequently used to finance commercial realty deals. These funds combine the capital of several investors to provide equity or debt financing to borrowers. This type of financing may not be suitable for everyone and should only be used with caution.

FAQ

Do I need flood insurance

Flood Insurance covers flooding-related damages. Flood insurance helps protect your belongings, and your mortgage payments. Learn more about flood insurance here.

Should I rent or purchase a condo?

Renting could be a good choice if you intend to rent your condo for a shorter period. Renting will allow you to avoid the monthly maintenance fees and other charges. You can also buy a condo to own the unit. The space is yours to use as you please.

What should you look out for when investing in real-estate?

First, ensure that you have enough cash to invest in real property. You can borrow money from a bank or financial institution if you don't have enough money. Also, you need to make sure you don't get into debt. If you default on the loan, you won't be able to repay it.

You should also know how much you are allowed to spend each month on investment properties. This amount must include all expenses associated with owning the property such as mortgage payments, insurance, maintenance, and taxes.

You must also ensure that your investment property is secure. You would be better off if you moved to another area while looking at properties.

Can I get a second loan?

Yes, but it's advisable to consult a professional when deciding whether or not to obtain one. A second mortgage is often used to consolidate existing loans or to finance home improvement projects.

What is a Reverse Mortgage?

A reverse mortgage lets you borrow money directly from your home. You can draw money from your home equity, while you live in the property. There are two types available: FHA (government-insured) and conventional. You must repay the amount borrowed and pay an origination fee for a conventional reverse loan. FHA insurance covers your repayments.

Is it possible to sell a house fast?

You may be able to sell your house quickly if you intend to move out of the current residence in the next few weeks. Before you sell your house, however, there are a few things that you should remember. First, you must find a buyer and make a contract. Second, prepare the house for sale. Third, advertise your property. Finally, you should accept any offers made to your property.

Can I purchase a house with no down payment?

Yes! Yes. There are programs that will allow those with small cash reserves to purchase a home. These programs include FHA loans, VA loans. USDA loans and conventional mortgages. For more information, visit our website.

Statistics

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

External Links

How To

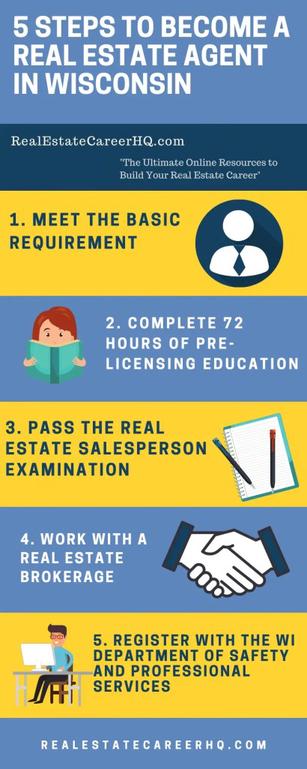

How to find real estate agents

The real estate market is dominated by agents. They sell homes and properties, provide property management services, and offer legal advice. A good real estate agent should have extensive knowledge in their field and excellent communication skills. Look online reviews to find qualified professionals and ask family members for recommendations. You may also want to consider hiring a local realtor who specializes in your specific needs.

Realtors work with residential property sellers and buyers. A realtor's job it to help clients purchase or sell their homes. Realtors assist clients in finding the perfect house. Most realtors charge a commission fee based on the sale price of the property. Unless the transaction closes, however, some realtors charge no fee.

The National Association of Realtors(r) (NAR), offers many different types of real estate agents. NAR membership is open to licensed realtors who pass a written test and pay fees. Certified realtors are required to complete a course and pass an exam. NAR designates accredited realtors as professionals who meet specific standards.