Knowing how much money you will need to invest in property is crucial for anyone who wants to make a career out of investing. It is important that you are realistic about what you can afford to spend on a property. Also, how you plan to save the funds for your first investment.

Get Started in Real Estate

One of the biggest barriers for new investors is simply not having the money to buy an investment property. There are many other ways to invest in realty without having to spend hundreds of thousands of money.

How much should I invest?

Real estate can be a great way to create wealth, but it's not for everyone. It is crucial to match your investment type with your personal goals.

Residential Rental Properties

It is popular to buy a single-family rental home as a way to get into real estate. This type of investment has a low down payment and can provide solid cash-on–cash returns over time.

Flipping Houses

Purchasing and renovating residential homes can be a profitable endeavor for many people, especially those who are willing to put in some work. Home-sharing platforms like Airbnb or Homeaway have become more popular in recent years.

Commercial Real Estate Investing

Many investors find commercial real estate more affordable than residential realty, and offers higher returns. It takes very little capital to invest in commercial real property investments like self-storage or office buildings.

Real Estate Investment Trusts (REITs)

REITs can be used as passive investment vehicles, and they offer both capital returns and dividends. These are also great for investors who don’t want to own and manage their property.

Private Lending

Another option to finance your real estate investment is hard money lending. This is where funds are raised from individuals or groups. These loans do not require a qualification and are not subject to government regulation.

There are many locations where you can make commercial real estate investments. These properties often have higher potential returns than residential properties. The key to successful investments in commercial realty is finding the right location and getting a good deal.

How to Get Started With Real Estate

After you have determined the amount of money you are able to afford to invest in property, you need to decide what type of investment you want to make. It is important to choose a property with the highest potential return.

You will then need to look for property in an area where there is strong demand and growth. You should look for a location with a population that has grown above-trend in the last few years.

FAQ

How much does it cost to replace windows?

Window replacement costs range from $1,500 to $3,000 per window. The cost of replacing all your windows will vary depending upon the size, style and manufacturer of windows.

How do I calculate my rate of interest?

Market conditions influence the market and interest rates can change daily. The average interest rate over the past week was 4.39%. The interest rate is calculated by multiplying the amount of time you are financing with the interest rate. For example, if $200,000 is borrowed over 20 years at 5%/year, the interest rate will be 0.05x20 1%. That's ten basis points.

What are the downsides to a fixed-rate loan?

Fixed-rate loans tend to carry higher initial costs than adjustable-rate mortgages. A steep loss could also occur if you sell your home before the term ends due to the difference in the sale price and outstanding balance.

How do I repair my roof

Roofs may leak from improper maintenance, age, and weather. Roofing contractors can help with minor repairs and replacements. For more information, please contact us.

What amount should I save to buy a house?

It depends on how long you plan to live there. Save now if the goal is to stay for at most five years. If you plan to move in two years, you don't need to worry as much.

Is it cheaper to rent than to buy?

Renting is often cheaper than buying property. However, renting is usually cheaper than purchasing a home. The benefits of buying a house are not only obvious but also numerous. For example, you have more control over how your life is run.

What should you look out for when investing in real-estate?

You must first ensure you have enough funds to invest in property. You will need to borrow money from a bank if you don’t have enough cash. You also need to ensure you are not going into debt because you cannot afford to pay back what you owe if you default on the loan.

It is also important to know how much money you can afford each month for an investment property. This amount should cover all costs associated with the property, such as mortgage payments and insurance.

Finally, ensure the safety of your area before you buy an investment property. It would be a good idea to live somewhere else while looking for properties.

Statistics

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

External Links

How To

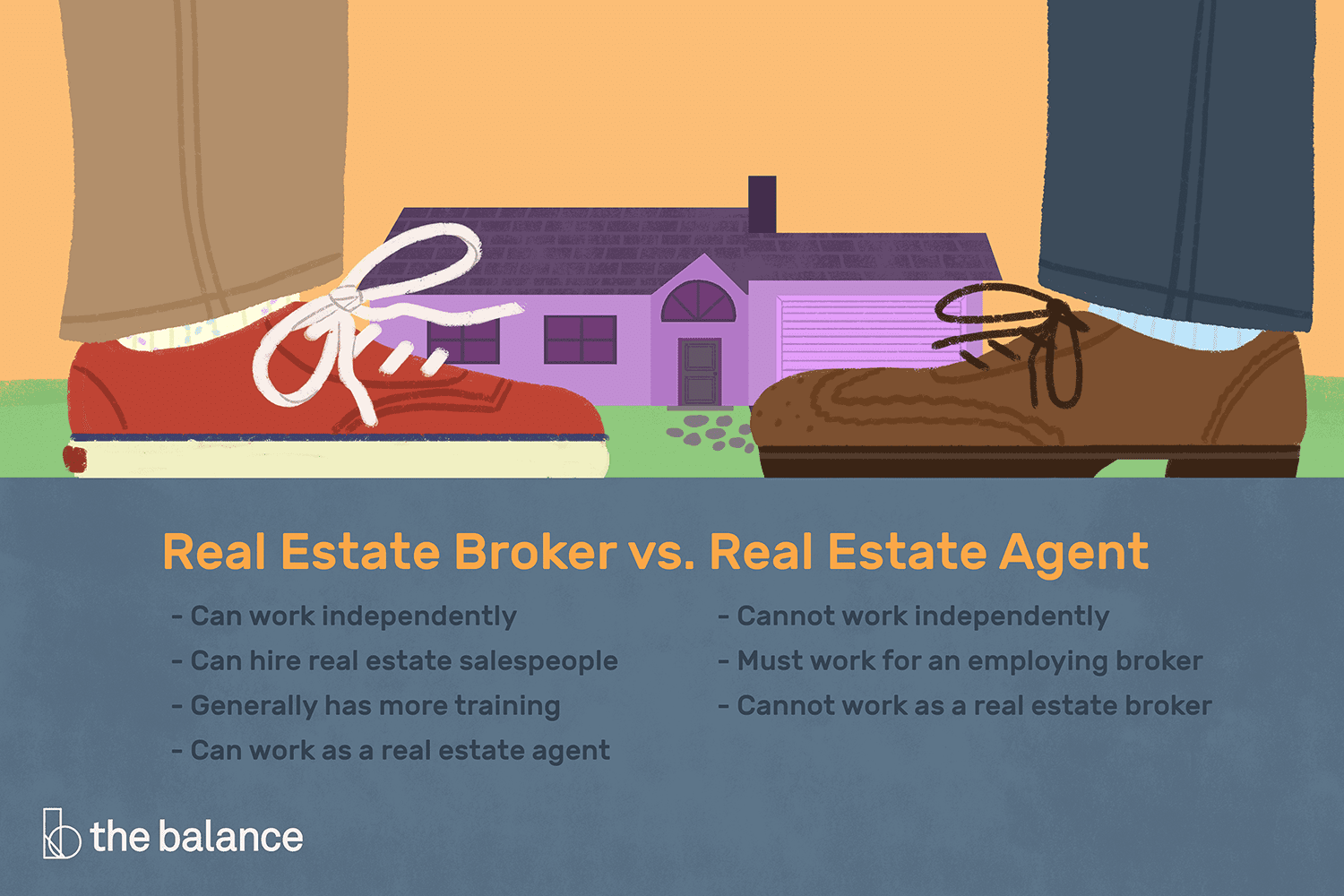

How to become real estate broker

To become a real estate agent, the first step is to take an introductory class. Here you will learn everything about the industry.

The next thing you need to do is pass a qualifying exam that tests your knowledge of the subject matter. This requires that you study for at most 2 hours per days over 3 months.

Once this is complete, you are ready to take the final exam. You must score at least 80% in order to qualify as a real estate agent.

All these exams must be passed before you can become a licensed real estate agent.