It is necessary to get your Alabama license if you wish to become a real-estate agent. It is quite simple but you will need certain steps. Read on to find out more.

First, you must obtain your license through the Alabama Real Estate Commission. This agency is responsible for ensuring that the market is fair and that all license holders are operating legally. The agency enforces high standards in renewal of licenses and new applicants.

After being approved to be a licensed agent in Alabama you will need a course. This education can be obtained in an online or traditional classroom setting. A variety of private companies and colleges offer these courses, but you will need to find an accredited one.

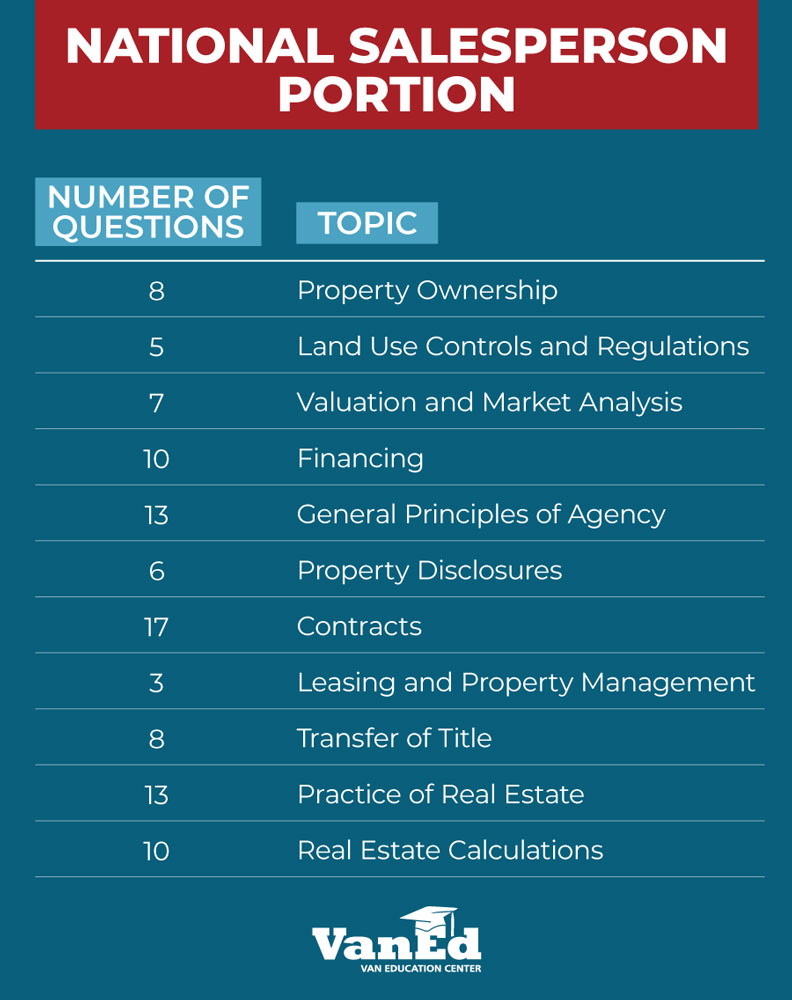

To obtain your license you will need pass a test, after you have successfully completed the pre-licensing courses. PSI administers this test. It measures your knowledge and understanding of real estate laws and concepts. You need to make sure that the test prep program you select includes questions that are specific to your state.

You will need to locate an exam center in order to take the test. These centers will give you an application and schedule you for an exam. You will need a government-issued photo ID as well as a signed document to arrive at the center. Your testing supervisor will let you know the results of your exam. You may bring a calculator that is not programmed to help you with the math portion.

Once you have passed your test, you will need to pay a $210 fee to the commission. Also, you will need to pass a background check. Having a clean criminal record will help the commission determine your honesty and integrity. Additional proof of residency will be required.

The real estate industry is subject to many laws and policies. These regulations and other laws will be important to you in order to perform your duties. Pre-licensing classes are offered by many schools and associations to prepare you for the state-mandated exam. Additionally, you should learn many laws and unwritten rules as you go.

An online real estate course is also available. Online courses are usually faster but you may be interested in an option that allows your to take as much as you can. Some programs even include live Q&A sessions with local instructors.

To pass the exam, you will need a licensed real estate course. The Alabama Real Estate Commission may endorse a program. You may require special permission for certain cases.

The course cost is not what you pay. This is the most expensive part of this entire process. It will depend on where you go and how much time it takes.

FAQ

Is it possible to sell a house fast?

You may be able to sell your house quickly if you intend to move out of the current residence in the next few weeks. Before you sell your house, however, there are a few things that you should remember. First, you need to find a buyer and negotiate a contract. You must prepare your home for sale. Third, it is important to market your property. You should also be open to accepting offers.

Can I buy my house without a down payment

Yes! Yes! There are many programs that make it possible for people with low incomes to buy a house. These programs include government-backed loans (FHA), VA loans, USDA loans, and conventional mortgages. Check out our website for additional information.

Is it better to buy or rent?

Renting is generally cheaper than buying a home. But, it's important to understand that you'll have to pay for additional expenses like utilities, repairs, and maintenance. Buying a home has its advantages too. You will be able to have greater control over your life.

What amount should I save to buy a house?

It all depends on how long your plan to stay there. You should start saving now if you plan to stay at least five years. But, if your goal is to move within the next two-years, you don’t have to be too concerned.

Statistics

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

External Links

How To

How to buy a mobile house

Mobile homes are houses that are built on wheels and tow behind one or more vehicles. Mobile homes are popular since World War II. They were originally used by soldiers who lost their homes during wartime. Mobile homes are still popular among those who wish to live in a rural area. These homes are available in many sizes and styles. Some houses have small footprints, while others can house multiple families. You can even find some that are just for pets!

There are two types of mobile homes. The first is made in factories, where workers build them one by one. This is done before the product is delivered to the customer. A second option is to build your own mobile house. Decide the size and features you require. Next, make sure you have all the necessary materials to build your home. You will need permits to build your home.

You should consider these three points when you are looking for a mobile residence. You might want to consider a larger floor area if you don't have access to a garage. Second, if you're planning to move into your house immediately, you might want to consider a model with a larger living area. Third, make sure to inspect the trailer. Damaged frames can cause problems in the future.

You need to determine your financial capabilities before purchasing a mobile residence. It is important that you compare the prices between different manufacturers and models. Also, look at the condition of the trailers themselves. Although many dealerships offer financing options, interest rates will vary depending on the lender.

Instead of purchasing a mobile home, you can rent one. Renting allows you to test drive a particular model without making a commitment. Renting isn't cheap. Most renters pay around $300 per month.